Cash Flow Management Tips for Growing Startups

Growing a startup involves ambition, quick decisions, and constant juggling of resources. One of the biggest reasons young ventures struggle or fail isn’t a lack of customers—it’s poor cash flow management. While sales might look promising on paper, cash shortages can grind operations to a halt. If you’re running a startup, managing your cash flow strategically can mean the difference between scaling up or shutting down.

Here are practical, straightforward cash flow management tips every growing startup should consider:

1. Separate Cash Flow From Profit

Many founders confuse profitability with having actual money in the bank. You might be selling more than ever, but if payments are delayed or expenses outweigh cash on hand, you could quickly find yourself in trouble.

Track cash inflow and outflow separately from your profit and loss statement. Focus on when money moves, not just how much. Understanding the timing of payments and expenses will give you clearer insight into your daily financial standing.

2. Create Realistic Cash Flow Projections

Forecasting isn’t just for big corporations. Small companies benefit even more from cash flow predictions. Use past data (if available) or reasonable assumptions to forecast incoming and outgoing funds for the next 3, 6, and 12 months.

Be conservative with your estimates—expect payments to be delayed and costs to rise. Having a cushion in your forecast allows you to make better decisions before trouble starts. This also helps when planning inventory, marketing pushes, or new hires.

3. Negotiate Vendor and Client Terms

Try to stretch out payments to suppliers while shortening the time it takes for clients to pay you. It’s a balancing act, but one worth mastering. For instance, instead of paying a vendor within 15 days, negotiate 30-day terms. On the flip side, encourage clients to pay faster with small incentives like discounts for early payment.

Being proactive here can help bridge the gap between money going out and money coming in—a key piece of maintaining smooth operations.

4. Avoid Overextending on Growth

Ambition is essential, but scaling too quickly can backfire if you don’t have the cash to support the pace. Big hires, new equipment, or expansion plans should be approached cautiously. Just because projections suggest future revenue doesn’t mean you can afford the expenses today.

Take calculated steps. Each financial commitment should be weighed against your current liquidity, not just your confidence in growth.

5. Use Tech Tools to Monitor Cash

Spreadsheets are helpful but limited. Today, there are plenty of affordable software solutions that can track, visualize, and alert you to cash flow trends. Some sync directly with your bank and accounting software, giving you a live view of your financial position.

Real-time data allows for faster reactions to dips or spikes in cash flow. Rather than waiting for monthly statements, you can pivot quickly if something is off track.

6. Set Aside an Emergency Buffer

While building an emergency fund sounds like advice better suited for personal finance, it’s equally crucial in business. A cash buffer can help your startup survive late payments, unexpected costs, or temporary drops in revenue.

Even saving a small percentage of revenue each month can build enough of a cushion over time. It’s often the thin line between survival and disaster during difficult stretches.

7. Regularly Review and Adjust

Cash flow planning isn’t a “set it and forget it” task. Your business will shift—sometimes rapidly. Make it a habit to review your projections monthly and compare them with reality. Are expenses higher than expected? Are specific clients consistently paying late? Being aware of patterns allows you to adapt quickly and avoid nasty surprises. Adjust your forecasts, payment terms, or spending habits based on real-time feedback.

Managing cash flow as a startup founder might not be glamorous, but it’s essential. By staying proactive and informed, you’ll not only keep the lights on but also create a stable base from which your business can grow. Don’t treat cash flow like an afterthought—it should be at the centre of your startup strategy.…

Wealth Building Secrets No One Told You About as a Business Owner

As a business owner, you’re constantly juggling numerous responsibilities. You’re focused on growth, customer satisfaction, and day-to-day operations. But somewhere in the hustle of building your empire, have you considered how to build lasting wealth? Many entrepreneurs overlook key strategies that could dramatically impact their financial future. Wealth isn’t just about making money; it’s about smart management and strategic planning. Involving professionals early—like an accountant or small business financial advisor—can uncover opportunities that align with your goals while navigating potential pitfalls effectively.

Today, we’ll uncover some wealth-building secrets that may not be common knowledge but can change the game for you as a business owner. It’s time to secure your legacy.

Compound Interest Is Your Best Friend

Compound interest is a powerful tool that many overlook. It works behind the scenes, quietly multiplying your wealth over time. The sooner you start investing, the more significant impact it can have. Think of compound interest as a snowball rolling down a hill. As it gathers momentum, it grows larger and larger with each turn.

Compound interest is a powerful tool that many overlook. It works behind the scenes, quietly multiplying your wealth over time. The sooner you start investing, the more significant impact it can have. Think of compound interest as a snowball rolling down a hill. As it gathers momentum, it grows larger and larger with each turn.

Even small investments made early can lead to substantial returns later on. As a business owner, consider reinvesting profits into your venture or making strategic financial decisions that capitalize on this principle. Whether through retirement accounts or investment portfolios, let your money work for you while you focus on running your business.

Tax Deferral Strategies

Tax deferral strategies can significantly impact your wealth-building journey. By postponing tax payments, you allow your investments to grow without the sudden burden of taxation. Consider utilizing retirement accounts like a 401(k) or an IRA. Contributions to these accounts often reduce taxable income, allowing more funds to remain invested longer. Another effective approach is using depreciation on business assets. This not only lowers your taxable profit but also enables reinvestment into growth opportunities without incurring tax penalties immediately. Real estate investors have options, too. Like-kind exchanges let you defer capital gains taxes when swapping properties, facilitating continuous investment increases.

How to Leverage Other People’s Money

Leveraging other people’s money can accelerate your business growth significantly. It’s all about using resources that don’t belong to you. Consider partnerships as a starting point. You can pool financial resources for shared projects by collaborating with investors or fellow entrepreneurs. This reduces personal risk while maximizing potential returns. Another avenue is through loans and credit lines. Banks and private lenders are often willing to finance promising ventures. Just ensure your business plan is solid; a well-prepared proposal increases your chances of securing funds. Crowdfunding platforms also offer an innovative approach.

Plan for Business Exit Early

Planning for a business exit is often overlooked, yet it’s crucial. The earlier you start thinking about it, the better prepared you’ll be to maximize your investment. Your options would be selling to another company, transferring ownership to family members, or even going public.

Planning for a business exit is often overlooked, yet it’s crucial. The earlier you start thinking about it, the better prepared you’ll be to maximize your investment. Your options would be selling to another company, transferring ownership to family members, or even going public.

Each route has its own set of complexities and advantages. Creating a solid exit strategy can add value to your business. Potential buyers want assurance that operations will run smoothly without you at the helm. Documenting processes and building a strong team are vital steps in this direction. Now, you’re exposed to secrets to financial freedom that many overlook in their entrepreneurial journeys. The road may be challenging at times, but with informed decisions and proactive planning, building lasting wealth becomes much more achievable.…

Compound Interest 101: How to Make Your Money Work for You

Are you ready to unlock the secret to growing your wealth effortlessly? Imagine if your money could work for you while you sleep, shop, or sip on a latte. Well, with compound interest on your side, that dream can become a reality. But hold on. What is compound interest? Basically, it’s the interest you earn on both your initial investment and any accumulated interest. So, over time, you’ll be earning interest on your interest. This powerful tool is one of the key elements in building long-term wealth. Find out more about growing compound interest by joining the Capital Club by Luke Belmar. The big question is, how do you make compound interest work for you? Well, that’s where we come in. In this guide, we’ll take you through the basics of compound interest and show you how to use it to build your wealth.

Start Your Investment Journey Early

The key to harnessing the power of compound interest to the fullest is to begin your investment as early as possible. The earlier you start your advantageous journey, the more time your money has to grow exponentially. Even small contributions can snowball into a significant nest egg over time.

The key to harnessing the power of compound interest to the fullest is to begin your investment as early as possible. The earlier you start your advantageous journey, the more time your money has to grow exponentially. Even small contributions can snowball into a significant nest egg over time.

By starting young, you can take advantage of compounding returns and see substantial growth in your investments. Time is truly your best friend when it comes to building wealth through compound interest. Whether you’re in your 20s, 30s, or beyond, taking that first step towards investing today will set you on the path toward a financially secure future.

Reinvest Dividends

Instead of pocketing your dividend payouts, why not try putting them back into your investment? This way, you can buy more shares of the stock or fund that generated those dividends in the first place. Reinvesting dividends essentially allows you to take advantage of compounding on a larger scale. Over time, it can significantly max out your overall returns without requiring additional effort on your part. It’s like planting seeds and then planting the fruits they bear – your money works harder for you when you let it grow continuously. The best thing is, this strategy not only accelerates wealth accumulation but also helps smooth out market fluctuations by purchasing more shares at varying prices.

Level Up Your Contribution Rates

Are you looking to supercharge your investment growth? One key strategy is to level up your contribution rates. By increasing the amount of money you invest regularly, you can accelerate the power of compound interest on your investments. Even small increases in your contribution rates can make a significant impact over time. Consider bumping up your contributions by just a few percentage points each year to see substantial growth in your investment portfolio.

Stay Invested for the Long Term

Just like you have heard thousands of times before, consistency is the key. When you commit to your investments over time, you allow them to grow and multiply organically. Imagine planting an apple seed and patiently watching it blossom into a fruitful tree. That’s how you’ll experience with your investment. Sure, market fluctuations may tempt you to pull out early, but staying the course can lead to significant returns in the future. At the end of the day, investing is never a sprint. It’s a marathon.

Just like you have heard thousands of times before, consistency is the key. When you commit to your investments over time, you allow them to grow and multiply organically. Imagine planting an apple seed and patiently watching it blossom into a fruitful tree. That’s how you’ll experience with your investment. Sure, market fluctuations may tempt you to pull out early, but staying the course can lead to significant returns in the future. At the end of the day, investing is never a sprint. It’s a marathon.

Final Thought

So if you’re consistent and able to weather all of those ups and downs you’ll find on the market, you’ll give your money the opportunity to work harder for you. Long-term investments also benefit from compounding gains over time. The longer your money stays invested, the more it has a chance to exponentially increase in value.…

The Essential Guide to Travel Insurance: What Every Traveler Needs to Know

Planning your next adventure is an exhilarating experience, filled with dreams of new destinations, cultural experiences, and unforgettable memories. Amidst the excitement, one crucial aspect that every traveler should consider is travel insurance. In this essential guide, we’ll explain everything you need to know about travel insurance, from its benefits to choosing the right coverage for your journey.

Understanding Travel Insurance: Why It’s Important

Travel insurance is your safety net, providing financial protection and peace of mind during your travels. It covers a range of unforeseen events, such as trip cancellations, long delays to the point where playing the castigates crossword clue is needed, medical emergencies, lost baggage, and more. While no one likes to think about worst-case scenarios, having travel insurance ensures that you’re prepared for the unexpected, allowing you to focus on enjoying your trip without worries.

Types of Coverage: Tailoring Insurance to Your Needs

There are several types of travel insurance to consider, each offering specific coverage based on your travel plans:

- Trip Cancellation/Interruption Insurance: Protects your investment in case you need to cancel or cut short your trip due to covered reasons such as illness, injury, or unforeseen events.

- Medical Coverage: This covers medical expenses, including hospital stays, doctor visits, and emergency medical evacuation. It is especially important when traveling abroad, where healthcare costs can be high.

- Baggage and Personal Belongings: Reimburses you for lost, stolen, or damaged luggage and personal items during your trip.

- Travel Delay: Provides coverage for additional expenses incurred due to flight delays, such as accommodation and meals.

- Emergency Assistance: This company offers 24/7 support and assistance services, including medical referrals, travel arrangements, and translation services.

Choosing the Right Policy: Tips for Travelers

When selecting a travel insurance policy, consider the following factors to ensure you get the coverage that meets your needs:

- Coverage Limits: Review the coverage limits for each type of insurance and ensure they align with the potential costs you may incur during your trip.

- Exclusions: Understand what is not covered by your policy, such as pre-existing medical conditions, extreme sports activities, or specific destinations with travel advisories.

- Add-Ons: Some insurance policies offer optional add-ons like rental car coverage, adventure sports coverage, or cancel-for-any-reason coverage. Assess if these additions are necessary for your trip.

- Read the Fine Print: Take the time to read and understand the policy wording, including terms, conditions, and exclusions. Clear comprehension of your coverage will prevent misunderstandings later on.

- Compare Quotes: Shop around and compare quotes from different insurance providers to find the best value for your coverage needs. Consider factors like price, coverage limits, and customer reviews.

Travel insurance is a vital investment that ensures you can explore the world with confidence and peace of mind. By understanding the types of coverage available, tailoring your policy to your specific needs, and choosing a reputable insurance provider, you’re not just protecting your trip; you’re safeguarding your travel experiences and memories.…

Navigating the Financial Landscape of Film Documentaries

Creating a compelling documentary film involves more than just capturing captivating footage and telling a compelling story. If you desire to achieve the same results as Jon Foy with resurrect dead on jupiter, you’ll need to consider investing in the project. Behind the scenes, filmmakers must navigate a complex financial landscape to secure funding, manage budgets, and ensure the successful production and distribution of their projects. In this guide, we’ll explore the key financial requirements for producing a film documentary, offering insights and tips to help filmmakers navigate the financial aspects of their projects effectively.

Pre-Production Expenses

The journey of creating a documentary begins long before the cameras start rolling. During the pre-production phase, filmmakers incur various expenses related to research, development, and planning. This includes costs associated with conducting interviews, obtaining archival footage, securing rights and permissions, hiring crew members, and scouting locations. Budgeting for pre-production expenses is essential to ensure that filmmakers have the resources they need to lay the groundwork for their film and set the stage for a successful production.

Production Costs

Production expenses account for the bulk of a documentary film’s budget. This includes costs related to equipment rentals, travel and accommodation, filming permits, insurance, and catering. Filmmakers must also budget for the salaries and wages of their production team, including directors, producers, cinematographers, and sound engineers. Additionally, unexpected expenses may arise during production, such as weather delays, equipment malfunctions, or last-minute changes to the filming schedule, so it’s essential to have contingency funds set aside to address unforeseen challenges.

Post-Production Expenses

Once filming is complete, the focus shifts to post-production, where raw footage is edited, sound is mixed, and visual effects are added to bring the documentary to life. Post-production expenses include costs associated with editing software and equipment, hiring editors and post-production crew, color grading, sound design, and music licensing. Filmmakers may also need to budget for expenses related to marketing materials, promotional screenings, and film festival submissions to promote their documentaries and attract audiences.

Distribution and Marketing Costs

Once the documentary is complete, filmmakers must navigate the distribution landscape to bring their film to audiences. This may involve securing distribution deals with streaming platforms, television networks, or film distributors or self-distributing the film through theatrical releases, DVD sales, or online platforms. Distribution and marketing costs include expenses related to advertising, public relations, film festival participation, and screenings. Filmmakers must develop a comprehensive distribution and marketing strategy and allocate resources accordingly to maximize the reach and impact of their documentaries.

Legal and Administrative Expenses

Throughout the production process, filmmakers must navigate various legal and administrative requirements to protect their rights and ensure compliance with industry regulations. This includes costs associated with obtaining legal counsel, drafting contracts and agreements, securing rights and clearances for music and archival footage, and obtaining errors and omissions insurance. Filmmakers must also budget for administrative expenses, such as accounting, payroll services, and film festival submissions, to ensure that their documentary is produced and distributed legally, soundly, and professionally.

Creating a documentary film is a multifaceted endeavor that requires careful planning, resource management, and financial acumen. By understanding the financial requirements associated with each stage of the production process and developing a comprehensive budget that accounts for all expenses, filmmakers can set themselves up for success and ensure the successful realization of their vision. While producing a documentary film may be a challenging and costly undertaking, the potential to inform, inspire, and impact audiences makes it a worthy investment for filmmakers passionate about storytelling and social change.…

Evaluating Financial Products: Choosing the Right Bank Accounts and Credit Cards

In the ever-evolving landscape of personal finance, selecting the right bank accounts and credit cards can significantly impact your financial well-being. With many options available, it’s essential to evaluate financial products wisely. For instance, holiday loans with no credit check can be tempting, but they often come with high interest rates and hidden fees. In this guide, we’ll discuss evaluating and choosing the best bank accounts and credit cards for your needs.

Bank Accounts

Bank accounts are a fundamental tool for managing your money, allowing you to store and access your funds safely. When selecting a bank account, there are several factors to consider. Most people prioritize convenience, fees, and interest rates. Convenience is essential because you’ll want to access your money easily. Consider the bank’s location and ATM network to ensure you can withdraw cash or make deposits without incurring extra costs. Online banking features such as bill payments and mobile check deposits are also vital for added convenience. Fees can significantly impact the value of a bank account. Some common fees include monthly maintenance, ATM, overdraft, and foreign transaction fees. Review the fee structure of potential bank accounts to understand what charges you may incur and how much they’ll cost.

Account Types

The two primary types of bank accounts are checking and savings accounts. Checking accounts typically offer convenient features such as debit cards, online banking, and bill payment options. These accounts are ideal for daily transactions and bill payments. Savings accounts, on the other hand, offer higher interest rates but have limited access to funds. They’re suitable for saving money you don’t need to access regularly, such as emergency funds or long-term savings.

Credit Cards

Credit cards can be valuable financial tools when used responsibly. They allow you to make purchases without immediately paying for them and offer rewards such as cashback or travel points. Consider the interest rate, annual fees, and reward programs when evaluating credit cards. The interest rate is crucial because it determines how much you’ll pay in interest if you carry a balance on your card. Annual fees are charges that some credit cards have for using their services and can range from $0 to several hundred dollars per year. Reward programs vary widely, so choose one that aligns with your spending habits and goals.

Most people prioritize either low-interest rates or rewards when choosing a credit card. If you carry a balance on your card, consider applying for a card with a low-interest rate. On the other hand, if you pay your bill in full each month, focus on finding a reward program that will benefit you most. Some common types of rewards include cashback, travel points, and store rewards. As with bank accounts, review the fees associated with each card to determine which offers the best value for your spending habits.

Importance of Regular Evaluation

Once you’ve selected a bank account or credit card, reviewing and evaluating its performance regularly is essential. As your financial needs and goals may change over time, so too should your choice of financial products. Consider factors such as fees, interest rates, and convenience to ensure that your money is working for you efficiently. Don’t be afraid to switch accounts or credit cards if you find a better option that aligns with your current financial situation. Regular evaluation can help you save money and make the most out of your finances.

Evaluating financial products might seem daunting, but with a thoughtful approach, you can make choices that align with your financial goals. By understanding your needs, assessing your spending habits, and considering the features of different bank accounts and credit cards, you can navigate the financial maze confidently. Remember, the right financial products can be powerful tools on your journey toward financial success.…

Why Continuous Learning Is Crucial for Scrum Masters in the Financial Services Industry

In the fast-paced and ever-changing financial services industry, Scrum Masters play a vital role in promoting agile methodologies and driving successful project management. However, to excel in their roles, Scrum Masters must embrace continuous learning. Continuous learning is crucial for Scrum Masters in the financial services industry due to the unique challenges and complexities they face. In this article, we will discuss four factors that highlight the importance of continuous learning for Scrum Masters in the financial services industry. If you’re interested in pursuing scrum master certification, you can read more to gain a comprehensive understanding of this valuable credential.

Evolving Regulatory Landscape

The financial services industry operates in a highly regulated environment. Regulatory frameworks are constantly evolving to address new risks and challenges. Scrum Masters must stay informed about these regulatory changes and understand how they impact project management practices. Continuous learning allows Scrum Masters to stay updated on regulatory requirements, compliance standards, and best practices.

Technological Advancements

The financial services industry is heavily reliant on technology and regularly experiences technological advancements. Scrum Masters need to stay abreast of these advancements to leverage emerging tools and methodologies for efficient project management. Continuous learning enables Scrum Masters to explore new technologies, understand their implications, and identify opportunities for innovation within their teams. By staying current with technological trends, Scrum Masters can guide their teams in implementing cutting-edge solutions, optimizing processes, and enhancing overall financial performance.

Market Trends and Customer Expectations

To be effective in the financial services industry, Scrum Masters must have a deep understanding of market trends and customer expectations. Continuous learning allows Scrum Masters to track market dynamics, monitor industry trends, and keep up with shifting customer preferences. By continually expanding their knowledge and insights, Scrum Masters can proactively adapt their project management strategies to align with market demands.

Enhancing Leadership and Communication Skills

Scrum Masters in the financial services industry often serve as leaders and facilitators within their teams. Continuous learning provides opportunities for Scrum Masters to enhance their leadership and communication skills. They can explore various leadership models, learn effective communication techniques, and develop interpersonal skills that foster collaboration and trust. By continuously refining their leadership prowess, Scrum Masters can create an environment where team members feel empowered, motivated, and engaged.

Continuous learning is essential for Scrum Masters operating in the complex and dynamic financial services industry. By embracing continuous learning, Scrum Masters can stay updated on evolving regulations, leverage technological advancements, understand market trends, and enhance their leadership and communication skills.…

The Economic Psychology of Buying and Selling Fire-Damaged Homes

Many people actually find buying and selling fire-damaged homes quite profitable. Buying or selling a fire damaged home is not without financial strategic planning. But have you ever wondered how they perceive the value and risks associated with purchasing a property that has been affected by fire?

That said, the process of buying and selling these homes is not without its challenges. In order to be successful in this market, it is important to understand the economic psychology behind the decision-making process of buyers and sellers. In the following article, we will discuss everything you need to know about buying and selling fire-damaged homes.

Perceived Risk and Value

The extent of the damage, structural integrity, and potential hidden issues can all contribute to perceived risk. Buyers may worry about the safety of the property or the possibility of lingering smoke or water damage. On the other hand, these properties often come with such a lower price tag compared to their undamaged counterparts.

This affordability factor can be enticing for buyers looking for a bargain or those who have limited budgets. However, this perceived value must be weighed against any additional costs that may arise from necessary repairs or renovations. Buyers also need to consider their tolerance for uncertainty when evaluating the perceived risk versus value proposition. Some individuals might feel comfortable taking on a project and investing in repairs themselves. Others may prefer move-in ready homes without any uncertainties looming over them.

Emotional Impact of Fire Damage

For homeowners who have experienced a fire, there is often a sense of loss and grief. Their once beloved home has been transformed into a shell of its former self. Memories are attached to every corner, making it difficult to let go. Sellers may feel overwhelmed by feelings of guilt or sadness as they navigate the process of selling their damaged property. On the flip side, buyers may be hesitant about purchasing a fire-damaged home due to concerns about safety and potential hidden issues. They might worry about lingering smoke odor or unseen structural damage that could cost them repairs down the line.

Potential for Bargaining

When it comes to buying and selling fire-damaged homes, one aspect that cannot be overlooked is the potential for bargaining. Fire damage can significantly reduce the value of a property, making it an attractive option for those looking to strike a deal. Buyers who are willing to take on the challenge of renovating a fire-damaged home often see the potential in turning it into their dream space. They understand that with some time and investment, they can transform what was once damaged into something beautiful. This understanding puts buyers in a unique position to negotiate on price. Sellers may be more pushed to sell quickly due to the stigma attached to fire-damaged properties and, therefore, may be open to accepting lower offers.

When it comes to buying and selling fire-damaged homes, one aspect that cannot be overlooked is the potential for bargaining. Fire damage can significantly reduce the value of a property, making it an attractive option for those looking to strike a deal. Buyers who are willing to take on the challenge of renovating a fire-damaged home often see the potential in turning it into their dream space. They understand that with some time and investment, they can transform what was once damaged into something beautiful. This understanding puts buyers in a unique position to negotiate on price. Sellers may be more pushed to sell quickly due to the stigma attached to fire-damaged properties and, therefore, may be open to accepting lower offers.

Future Concerns and Resale Value

One of the main concerns for buyers is whether they will be able to recoup their investment when they decide to sell in the future. Fire damage can significantly impact a home’s resale value, as potential buyers may perceive it as a risky purchase. They may worry about hidden structural issues or lingering smoke odors that could affect their quality of life or make it difficult to resell later on. The location of the property also plays a crucial role in determining its future prospects.

Buying or selling a fire-damaged home requires careful consideration of financial implications alongside emotional factors. It is crucial for sellers to present their damaged properties in the best possible light while being transparent about their history. Similarly, buyers must conduct thorough inspections before committing to a purchase.…

The Cons of Holiday Tax Loans

Holiday tax loans are emergency loans based on anticipated tax refunds taken before the refund is received. The idea is to obtain money quickly for a holiday season purchase or expense. While these loans can be convenient and appealing, several potential drawbacks should be considered before taking out a loan. So, if you are planning to take out holiday tax loans, you should know some things. Below are the cons of holiday tax loans.

They Offer Higher Interest

The first con of holiday tax loans is that they typically come with higher interest rates than traditional loans. This is since the loan is short-term, and the lender takes on more risk in providing it. The APR can be anywhere from 100% to several hundred percent, depending on the lender and loan terms.

The first con of holiday tax loans is that they typically come with higher interest rates than traditional loans. This is since the loan is short-term, and the lender takes on more risk in providing it. The APR can be anywhere from 100% to several hundred percent, depending on the lender and loan terms.

This is one of the reasons that many people opt for this as a last resort when they need money quickly. In many cases, borrowers have taken out a holiday tax loan, only to find themselves deep in debt and unable to pay off the loan.

They Have Limited Loan Amounts

The second con of holiday tax loans is that they typically have limited loan amounts. Typically, lenders cannot offer more than $1,000 in emergency funding as it would be too much of a risk for them. If you need more than that amount, you will have to look elsewhere. This can be especially problematic if you need more substantial funding for a large holiday purchase or expense. Many people need a larger amount than is available through these types of loans.

They Come With Penalties

The third con of holiday tax loans is that they often come with late payment fees or other penalties if the loan is not repaid promptly. Depending on the lender, these fees can be steep and can make it difficult to repay the loan. Furthermore, some lenders may impose additional fees for early repayment of the loan. This is important to consider if you are planning on taking out a loan, as it can effectively increase the cost of the loan and make it more difficult to repay. Which is why it is important to thoroughly review the loan terms before signing the agreement.

They Require Perfect Credit

The last con of holiday tax loans is that they typically require impeccable credit to be approved. Most lenders will not consider borrowers who have a history of late payments or a low credit score. This means that if you do not have perfect credit, you may find it difficult to qualify for this type of loan.

The last con of holiday tax loans is that they typically require impeccable credit to be approved. Most lenders will not consider borrowers who have a history of late payments or a low credit score. This means that if you do not have perfect credit, you may find it difficult to qualify for this type of loan.

Additionally, some lenders may require collateral to obtain the loan, which can be difficult to provide if you are already struggling financially. Which is why it is essential to assess your credit score and financial standing before taking out a holiday tax loan. This can save you from unnecessary financial strain and frustration.

While holiday tax loans can be an attractive option for those in need of emergency funds, it is essential to consider the potential drawbacks before taking out a loan. They typically come with high-interest rates, limited loan amounts, penalties for late or early repayment, and often require perfect credit. It is important to carefully review the loan terms and ensure that you can meet all of the requirements before signing any agreement. This can help save you from financial strife in the long run. By considering all of these cons, you can be sure that you are making an informed decision when taking out a holiday tax loan.…

Why You Should Not Invest in Bitcoin

There has been a lot of buzz around Bitcoin lately. Some people call it the next big thing, while others believe it is a bubble about to burst. So, what is Bitcoin, and should you invest in it? This blog post will discuss the cons of investing in Bitcoin and why you should not do it.

Bitcoin Is a Volatile Investment

One of the main reasons why you should not invest in Bitcoin is because it is incredibly volatile. The value of Bitcoin can go up or down by a significant amount in a concise period. This means that if you invest in Bitcoin, you could lose a lot of money quickly.

One of the main reasons why you should not invest in Bitcoin is because it is incredibly volatile. The value of Bitcoin can go up or down by a significant amount in a concise period. This means that if you invest in Bitcoin, you could lose a lot of money quickly.

Unfortunately, many investors have lost much money by investing in Bitcoin. Even though Bitcoin Bank Breaker and many other Bitcoin investment programs claim to have made people a lot of money, the reality is that these programs are often scams.

The Market for Bitcoin Is Unregulated

As an investor, you are taking a massive risk by investing in bitcoin. Unlike stocks and bonds, no government regulator oversees the bitcoin market. This means that if you purchase bitcoin and something goes wrong, there is no guarantee that you will get your money back.

It is nearly impossible to regulate the market for bitcoin because it is decentralized. This means that there is no central authority that oversees the market. Instead, the market is run by a network of computers that are all around the world. Although, as an investor, you might be attracted to the idea of investing in something that any government does not regulate, you should be aware of the dangers that come with this.

Bitcoin Is Not Backed by Anything

Another reason you should not invest in bitcoin is because it is not backed by anything. This means that if the value of bitcoin were to drop, there would be no safety net to protect your investment.

Another reason you should not invest in bitcoin is because it is not backed by anything. This means that if the value of bitcoin were to drop, there would be no safety net to protect your investment.

Unlike stocks or bonds, which a company or government typically backs, bitcoin has no such support. This makes it a very risky investment, especially when compared to more traditional options. You can not insure a bitcoin investment against loss, so if the value drops dramatically, you could lose everything you put in.

There Are Many Better Investments

Although it can be tempting to put all of your money into Bitcoin, many better and more stable investments are available. For example, investing in stocks or mutual funds gives you the potential to earn a much higher return on your investment than what you would get from Bitcoin.

So, if you’re considering investing in bitcoin, research the risks involved. It’s not an investment for everyone, and knowing what you’re getting into is essential before putting any money down. Thanks for reading.…

Best Strategies to Purchase an Ideal Private Health Insurance Plan

There are a lot of things to think about when purchasing private health insurance. Do you want to go with a big company or a smaller one? What kind of plan do you need? How much can you afford to spend? It can be challenging to purchase private health insurance, but with the right strategies in place, you can find an ideal plan that meets your needs. Health insurance plans vary but make sure you purchase the right one. In this blog post, we will discuss some of the best strategies for purchasing private insurance so that you can make an informed decision and get the best coverage possible.

Make a List of What You Need in a Plan

When purchasing the best health insurance plan for you, the first step to purchasing private health insurance is to make a list of what you need in a plan. Do you need coverage for prescriptions? How about dental and vision? What about mental health services? Once you know what you need, you can start shopping around for plans that offer your desired coverage. Some people may also want to consider things like co-pays and deductibles when making their decision.

When purchasing the best health insurance plan for you, the first step to purchasing private health insurance is to make a list of what you need in a plan. Do you need coverage for prescriptions? How about dental and vision? What about mental health services? Once you know what you need, you can start shopping around for plans that offer your desired coverage. Some people may also want to consider things like co-pays and deductibles when making their decision.

Think of Your Budget

Even though having health insurance is essential, you must also consider your budget when making a purchase. How much can you afford to spend each month on premiums? What about out-of-pocket costs? Once you have an idea of your budget, you can start looking at plans that fit within your price range. It’s essential to find a plan you can afford so that you’re not struggling to make monthly payments. So be sure to include the plan’s cost in your decision-making process.

Compare Rates and Benefits

Health insurance companies offer different rates and benefits, so it’s important to compare them before purchasing. What works for one person may not work for another, so finding a plan that meets your specific needs is essential. Make sure to compare the rates of different companies and the benefits they offer before making a decision. By doing your research, you can be sure to find the best possible plan for you.

Read the Fine Print Before Signing

On top of that, it’s important to read the fine print before signing up for a health insurance plan. This way, you’ll know exactly what you’re getting into and won’t be surprised by anything later on. Make sure to understand the terms of your plan before agreeing to anything to ensure you’re getting the best possible coverage.

On top of that, it’s important to read the fine print before signing up for a health insurance plan. This way, you’ll know exactly what you’re getting into and won’t be surprised by anything later on. Make sure to understand the terms of your plan before agreeing to anything to ensure you’re getting the best possible coverage.

By following these steps, you can be sure to find the best possible health insurance plan for you. Purchasing private health insurance can be complicated, but it’s best to ensure you have the coverage you need. By taking the time to compare rates and benefits, as well as reading the fine print, you can find a plan that meets your needs and budget. So don’t wait. Start shopping around for the best possible health insurance plan today.…

Pros of Working With a Mortgage Broker

Suppose you read this post. Congratulations! I assume you’ve planned to buy a new home. It’s a good idea to finance your home by applying for a mortgage. However, it’s getting much more complicated to apply for the best mortgage for you in today’s world. So, to make your life a lot easier, you need to hire one of the best professional mortgage brokers. This post will explain why you need to hire a mortgage broker and the benefits of hiring an experienced broker. Read on.

Promotes Convenience

As mentioned, the main goal of hiring a mortgage broker is to make your life a whole lot easier when applying for a mortgage. So, they offer complete service and dedication to help you get the best mortgage for you.

As mentioned, the main goal of hiring a mortgage broker is to make your life a whole lot easier when applying for a mortgage. So, they offer complete service and dedication to help you get the best mortgage for you.

It means you can rest assured knowing that the broker can find the best mortgage, prepare all necessary paperwork, set a schedule, and negotiate to qualify for a mortgage. Aside from that, they are highly flexible people who can help you at any time.

Completes the Legal Work

A mortgage broker is also a highly competent person in handling any legal work. They can do all the legal work for you to get the best loan possible for your next property. This responsibility includes the loan application, necessary documents for the bank, and all the negotiations. You can choose to go through this process alone, but hiring a professional mortgage broker can prevent you from dealing with a complicated process.

Saves a Lot of Time

One of the best reasons you need to hire a mortgage broker is that you can make the whole process quick and easy. The mortgage brokers are professionals regarding how your preferred bank and lender operate, along with the criteria you must meet. These criteria will lead you to get applied for the mortgage. However, make sure to hire an experienced person that can ensure success in your mortgage application.

Increases the Chance of Getting Pre-Qualified

As we know, you have two potential outcomes when you decide to apply for a mortgage. It’s either getting approved or getting rejected. The banks or lenders always put a mark on your credit score whenever your application has got denied. It’s when the mortgage broker comes in handy. They are capable of using the latest technology to gain access to the criteria of each bank and make sure you are qualified to apply for the mortgage. It’s essential to avoid having any negative marks on your credit score so that you have nothing to worry about when you need to apply for a mortgage later.

As we know, you have two potential outcomes when you decide to apply for a mortgage. It’s either getting approved or getting rejected. The banks or lenders always put a mark on your credit score whenever your application has got denied. It’s when the mortgage broker comes in handy. They are capable of using the latest technology to gain access to the criteria of each bank and make sure you are qualified to apply for the mortgage. It’s essential to avoid having any negative marks on your credit score so that you have nothing to worry about when you need to apply for a mortgage later.

To sum up, a mortgage application process can be super hectic and complicated. So, if you want to make your life easier, you need to hire a professional mortgage broker. If you do, you can enjoy a lot of benefits, and rest assured you’ll get approved for the mortgage. However, it’s essential to hire a professional mortgage broker that has a legitimate license and certificate. Also, ensure you know that the broker is reliable and trustworthy. Thus, you can get your mortgage with no issues.…

Mistakes People Make When Getting a Loan

Sure, it can be exciting walking into a lender’s office and walking out with a chunk of cash in your account. You might also have a rough idea of what you want to do with your 2nd chance loan. Perhaps you have a well-thought-out plan down to the details. Whichever side of the divide you fall on, there are mistakes that you definitely should avoid when getting a loan. Some of these mistakes are made by right about anyone. For this reason, read on for more on mistakes people make when getting a loan.

Not Working on Your Credit Score

Do you know your credit score? Are there ways you can perhaps improve on it? Almost all lenders count on your credit score to know how much to give you.

Do you know your credit score? Are there ways you can perhaps improve on it? Almost all lenders count on your credit score to know how much to give you.

You might have an excellent business plan, but you might not be approved if your credit score is low. There are many facilities out there that can let you know what you need to work on. You can even have them synced with your phone, so you get regular reports on what you need to work on.

Not Consulting a Financial Advisor

Sure, getting a loan is not entirely a complex matter. However, to make sure you do not fall into any traps, look for a financial advisor. They will tell you when you are being ripped off and which other funding you can go for. For instance, there is capital funding and equity funding. It all depends on the vehicle you prefer.

Not Fully Disclosing Your Financial Affairs

To strike the best deal, make sure you have disclosed everything to your potential lender. Do not tie yourself to something you can fulfill. For example, do not overplay your income potential in a bid to get a bigger loan. You might end up tying yourself to something that will frustrate you for a long time. To add to the above, avoid many loan applications at the same time. You might end up being accepted on all of them!

To strike the best deal, make sure you have disclosed everything to your potential lender. Do not tie yourself to something you can fulfill. For example, do not overplay your income potential in a bid to get a bigger loan. You might end up tying yourself to something that will frustrate you for a long time. To add to the above, avoid many loan applications at the same time. You might end up being accepted on all of them!

Conclusion

It can be intimidating and thrilling at the same time when you are getting a loan. Nonetheless, with these things in mind, you are good to go. This article has narrowed down to all the things you should look out for to avoid making mistakes when getting a loan. After all, a loan can sometimes be a huge commitment that binds you for very many years. So, be careful out there!…

Selecting the Right Loan Lender

When you are looking for a lender, there is no one-size-fits-all solution. There are many considerations to make when selecting the best loan lender for your needs.

With many lenders offering loans, it can be hard making the right choice. This article will explore some of those factors and give you some things to consider before deciding on the right lender for your situation.

Choose a Regulated Lender

You need to ensure that the lender you work with is regulated. This ensures that they are committed to best practices and will be around for the long term. For example, if your loan provider suddenly decides it wants to close down one day, then this could leave you stranded without a way of paying back your loans or receiving any repayments on them.

You need to ensure that the lender you work with is regulated. This ensures that they are committed to best practices and will be around for the long term. For example, if your loan provider suddenly decides it wants to close down one day, then this could leave you stranded without a way of paying back your loans or receiving any repayments on them.

The Financial Conduct Authority (FCA) regulates UK-based lenders, so you need to ensure that your provider is registered with them. You can check this quickly by visiting the FCA register and searching for the company’s name or registration number (provided on their website). If they are not listed, it may indicate problems finding out any information about them via a Google search or social media.

This is not the only regulator that credit providers need to be registered with. Many will also register with other bodies, such as the Information Commissioner’s Office (ICO) and/or Companies House. Other countries also have bodies regulating lenders, so you should ensure that your provider is registered with them.

Find Out How Long the Company Has Been in Business

You also need to find out how long the lender has been in business. Look for a company that is established and proven. You want to avoid new companies, as they may not have had enough time to establish themselves on the scene yet.

You also need to find out how long the lender has been in business. Look for a company that is established and proven. You want to avoid new companies, as they may not have had enough time to establish themselves on the scene yet.

Experience is also very important when it comes to choosing a lender. Experienced loan lenders tend to have a better grasp of the market and how to work it. New companies also tend to have higher interest rates since they are just starting to build up their client list.

New lenders may be able to offer you a great deal right now, but what about down the road when other clients come knocking? Will your lender still want your business and be able to offer you a competitive interest rate? If your lender can’t give an exact answer on how long they have been in business, then they probably haven’t been around for too long. You should steer clear of them and find someone who has more experience instead.

On the other hand, if they aren’t transparent about their history, they may have something to hide. You don’t want a lender who has been in business for five years and is just now starting to branch out into your state or city. They should already be established there by this point if they will give you the best interest rates possible when it comes time for you to sign all of those loan papers.

Check to See if There Have Been Any Complaints Against Them

Not every loan lender that promises to get you the lowest interest rate is telling the truth. Some of them could be scam artists trying to steal your money. Before you do business with any lender, make sure that they are in good standing and have a reputation for being honest people who will look out for your best interests when all is said and done.

You can find this information by doing some easy online research. There should be plenty of reputable sources telling you all about the lender and their past clients. You could also contact your local Better Business Bureau to find out if any complaints have been filed against them recently before you sign on the dotted line with a potentially dishonest company.

It’s essential to make the right financial decisions. If you are looking for a loan lender, you must choose one who will provide your best interest. You’ll want to make sure they have an excellent reputation and offer competitive rates on their loans.…

Effective Ways to Maintain Your Car

If you are reading this blog post, the chances are that you want to learn more about how to maintain your car. There are a number of people who take out a loan to help in the maintenance of their car. If you are in places like Australia, you have many options. By doing some research, you can find the best car finance.

There are many different ways to maintain your car but to get the best results. There are a few things that you should be doing regularly because some parts of the car need to be maintained daily. This is one of the most important things that many car owners neglect. Below are some of the ways that you can keep your car.

Check the Tire Pressure

Regularly and keep them properly inflated. Many people have got into an accident due to underinflated tires. It would help if you first looked at the tire pressure before you start your car. This is very important because it can make your passenger’s life and your life safe. It is also essential to check the pressure of your spare tire because most of the time it is empty. Many people end up stuck in the middle of the road because of this. And that is what you need to avoid.

Regularly and keep them properly inflated. Many people have got into an accident due to underinflated tires. It would help if you first looked at the tire pressure before you start your car. This is very important because it can make your passenger’s life and your life safe. It is also essential to check the pressure of your spare tire because most of the time it is empty. Many people end up stuck in the middle of the road because of this. And that is what you need to avoid.

Check the Battery

You need to make sure that your car’s battery is in the best condition. You should regularly check it, and if you find any problems with it, you need to replace it immediately. Do not wait for something bad to happen because batteries are dead when they are needed most of the time. Check if it is corroded because if you have a corroded battery, this can cause many problems. This includes acceleration problems, the headlights not working properly, and issues with your car’s electrical system.

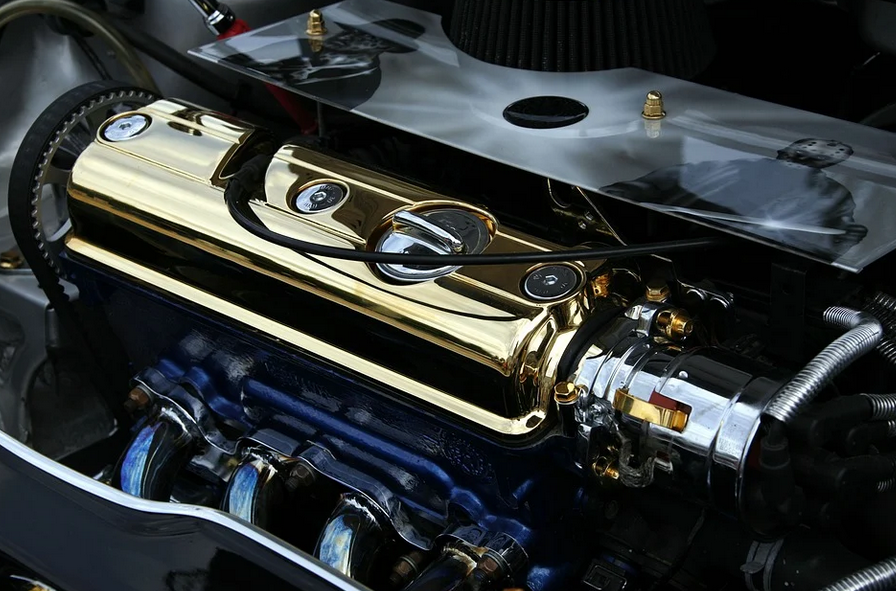

Clean the Engine

If your car has a dirty engine, it will affect the performance of your engine. It will reduce its life, and this means that you need to clean it regularly. Many people have experienced that their car engine has failed after working for more than 100,000 miles. They got stuck in the middle of somewhere and had to call for assistance.

If your car has a dirty engine, it will affect the performance of your engine. It will reduce its life, and this means that you need to clean it regularly. Many people have experienced that their car engine has failed after working for more than 100,000 miles. They got stuck in the middle of somewhere and had to call for assistance.

Check the Filters

The air filter in your engine may be dirty, so it is important to replace this every few months or so. It could cause the engine to work much harder than necessary and lead to major problems down the road if you don’t maintain it regularly. The same goes for your cabin air filter. This will be located behind one of the glove compartments and should also be changed every so often, especially if you have pets or smoke in your car a lot.

A little bit of work and effort on your end can go a long way to keeping your car in good shape. Every car owner should know that maintaining your vehicle is important, but it doesn’t have to be hard. There are a few things that can help you maintain your car. You could follow the advice of this blog post or find other ways to keep it running well. The choice is up to you.…

Six Reasons to Take a Payday Loan in San Diego

San Diego is a beautiful city filled with many different people and cultures. The downtown area has a lot of entertainment options, and the beaches are perfect for those hot summer days. San Diego also has one of the most expensive housing markets in the country, which means it’s hard to afford living here without some help from payday loans.

There are many reasons you might need a quick cash infusion to make ends meet – home repairs that came up out of nowhere or an unexpected medical bill can quickly lead to financial hardship. Payday loans can be your best option if you’re looking for fast money! Here are the top reasons why you should take one now:

You Want Peace of Mind

Financial problems can create sleeping troubles and anxiety issues. A payday loan will give you back your peace of mind and allow you to sleep soundly at night, knowing that everything is taken care of on time with no problems or stress!

Financial problems can create sleeping troubles and anxiety issues. A payday loan will give you back your peace of mind and allow you to sleep soundly at night, knowing that everything is taken care of on time with no problems or stress!

You Need a Quick Fix

Sometimes there’s just no way around getting extra money quickly, even if it means going further into debt. A payday loan will give you the money you need right away, and it’s much better to have a quick fix than no solution at all.

You Want to Fix Your Credit Rating

Getting your finances back on track can be difficult when you’re already struggling with bad credit because of an unexpected payday loan that turned into more trouble than what was intended.

Getting your finances back on track can be difficult when you’re already struggling with bad credit because of an unexpected payday loan that turned into more trouble than what was intended.

A payday loan can help you get back on track and build your credit score up again. It is indeed a good investment to make especially in this difficult time.

You Need to Make an Emergency Purchase

The unexpected happens, but when it does, you must be prepared for the worst with a solid emergency fund! Getting approved for a quick payday loan will allow you to make that purchase without worry or stress.

You Can’t Get a Loan Anywhere Else

There are many reasons why you might not get a traditional loan from a bank, but that doesn’t mean there isn’t another solution. A payday loan is your best option when other sources of cash won’t work out for whatever reason!

It’s Your Only Option

Sometimes you don’t have a backup plan when it comes to getting extra cash for whatever reason. When you need money ASAP, nothing else will do!

Sometimes you don’t have a backup plan when it comes to getting extra cash for whatever reason. When you need money ASAP, nothing else will do!

Payday loans are your best option in these circumstances, and they’re available 24/hrs a day with no waiting period until approval.

The Bottom Line

As a resident of San Diego, myself, I know how difficult it can be to make ends meet when you’re supporting a family and trying to pay your bills on time each month. Taking out a payday loan is never ideal, but sometimes there’s no other way around the situation! Payday loans will give you peace of mind knowing that everything will get paid and not cause any financial problems.…

Tips for Applying for a Quick Cash Loan

The financial constraints in the economy push most people to apply for a loan. Sometimes, you find people borrowing money to cater for utility bills or emergencies. In such cases, lending from the bank may be a tedious process and not an option because it may take longer to process a loan. Consider applying for a quick loan if you need money urgently because it takes a few hours for the lender to approve the loan, usually at least 24 hours. My Quick loan offers Fast loans with instant payout. Here are essential tips to consider when choosing the best quick loan lender.

Check Their Accreditation

Before choosing the best lender for your loan, it is essential to check whether they have the necessary paperwork. If you deal with a lender that does not have the proper license, you may land into problems such as increased interest rate, or they may shorten their repayment period, thus being untrustworthy to work with.

Before choosing the best lender for your loan, it is essential to check whether they have the necessary paperwork. If you deal with a lender that does not have the proper license, you may land into problems such as increased interest rate, or they may shorten their repayment period, thus being untrustworthy to work with.

When choosing the right company to issue a quick loan, consider checking the license of the lenders. It is prudent to check if the lender has a valid license to operate and ensure that you choose lenders with a good reputation and who follow the industry standards.

Consider Their Interest Rates

The most crucial factor to consider when selecting a quick loan lender is their interest rates. The disadvantage of borrowing money from quick loan lenders is that they have high-interest rates, making it difficult for borrowers to repay them fully on time. Most lenders take advantage of borrowers because they know that they are in dire need of money. Therefore, before making your final decision with your lender on the amount of loan to borrow, consider negotiating their interest rates of the loan.

The most crucial factor to consider when selecting a quick loan lender is their interest rates. The disadvantage of borrowing money from quick loan lenders is that they have high-interest rates, making it difficult for borrowers to repay them fully on time. Most lenders take advantage of borrowers because they know that they are in dire need of money. Therefore, before making your final decision with your lender on the amount of loan to borrow, consider negotiating their interest rates of the loan.

Check Their Repayment Method

When applying for a quick loan, it is essential to consider the method of repayment. You can consider providing a postdated look on your lender so that you can get your payment on a specific date. It is essential to ask them to provide you with your checking account number, and the lender can only remove the amount you are required to pay.

When applying for a quick loan, it is essential to consider the method of repayment. You can consider providing a postdated look on your lender so that you can get your payment on a specific date. It is essential to ask them to provide you with your checking account number, and the lender can only remove the amount you are required to pay.

Check Their Process Period

When choosing the right lender, ensure that you select a person that can process your money quickly. In this case, you need to remember that you are borrowing money for emergencies, and you need a lender that can approve your loan within a short period. Therefore, it does not make sense to choose a lender that takes longer to approve your loan.

Finding convenient lenders is an advantage because they allow online applications, and they can process your funds within a short time. Nowadays, most lenders require their applications for loans to be done online to fasten the approval process, unlike banks with a lengthy screening process that is complicated and could lead to denial of loans.

…

Choosing the Right Credit Card Processing Service

There is a lot that comes into play when one is managing a successful business. It is crucial to ensure that you are running your business by using what technology has to offer. Most people in some countries prefer to use credit cards as a way of payment.

Although physical cash is still crucial in today’s economy, many people prefer not to use cash when making transactions. Credit card processors are crucial in helping customers pay for the services and goods they get by using their credit cards.

Because of the increasing demand, many businesses like VMS Flatrate offer credit processing services to other companies. Here is a list of factors that will help you choose the right credit processing service.

Fees

The first factor that will be crucial in helping you choose a credit processing service is the associated costs. It is vital to note that credit processing services will charge a fee for their services. Different service providers will ask for a fee that varies. Most business owners choose credit card processing companies that ask for low prices.

The first factor that will be crucial in helping you choose a credit processing service is the associated costs. It is vital to note that credit processing services will charge a fee for their services. Different service providers will ask for a fee that varies. Most business owners choose credit card processing companies that ask for low prices.

Although cheap service providers may seem ideal, it will pay off to be cautious. It is crucial to ensure no hidden additional costs are present in an agreement before selecting any credit card processing service. Most credit processing service that charges a significant fee tend to offer quality services.

Ratings

Apart from the fees that credit card processing services charge, it is will be essential to consider the approval ratings. Most credit processing service providers make claims that they are the best at what they do. As you may end up spending lots of money hiring a credit card processing service, you need to choose the right service provider.

Apart from the fees that credit card processing services charge, it is will be essential to consider the approval ratings. Most credit processing service providers make claims that they are the best at what they do. As you may end up spending lots of money hiring a credit card processing service, you need to choose the right service provider.

To get the best credit card processing service, you should select a service provider with high approval ratings from other businesses. Apart from ratings, it would help if you also made an effort to read reviews from those who have worked with a particular credit card processing service.

Features

The last factor you should consider is the type of features that a credit processing service offers. There are some services with features that include online payments. Others services may have swipers and virtual terminals.

The credit processing service you select should have features that your business needs. A good example is some businesses may need credit processing services to store customers’ payment information.

Finding the right credit processing service will be crucial in helping your business succeed. Ensure that you consider the fees, features, and ratings when selecting a credit card processing service.…

3 Reasons Why You Should Get a Health Insurance

The current COVID-19 pandemic has made the world aware that medical needs are unpredictable and can cause financial upheaval challenging to bear. With a high rate of illness without an effective vaccine, people have realized the importance of excellent health insurance. A person cannot plan and get sick, but they can be prepared for the monetary aspect. One such technique to arm oneself financially against uncertain health risks is to take out health insurance. Self-employed or any individual is advised to have health insurance for added protection.

Listed below are the significant advantages of acquiring health insurance:

Minimize Unexpected Hospital Bills

Health insurance provides financial protection in the event of a severe injury or illness. If you don’t have insurance, you will have to pay all medical bills. If you only pay for annual checkups or a class of antibiotics, these bills may not matter much. However, if something happens to you, such as an accident or a severe illness, such as a chronic ailment, you will have to pay for all treatment and care. In addition, medical insurance covers other things like hospitalization, daycare processes, household expenses, and ambulance costs. This allows you to focus on your speedy recovery instead of worrying about these high costs.

Health insurance provides financial protection in the event of a severe injury or illness. If you don’t have insurance, you will have to pay all medical bills. If you only pay for annual checkups or a class of antibiotics, these bills may not matter much. However, if something happens to you, such as an accident or a severe illness, such as a chronic ailment, you will have to pay for all treatment and care. In addition, medical insurance covers other things like hospitalization, daycare processes, household expenses, and ambulance costs. This allows you to focus on your speedy recovery instead of worrying about these high costs.

Safeguard Your Family

When looking for the ideal health insurance policy, you can cover your entire family with the same coverage instead of buying separate policies. Think about your elderly parents, who are the most likely to get sick, as well as your dependent children. If something happens to them, you don’t have to worry about getting the best medical care if you have the right health insurance. Do your research thoroughly, talk to professionals to get an unbiased opinion, and make sure you purchase a plan that offers comprehensive coverage.

Deal with Medical Inflation

Healthcare prices have increased dramatically in recent times. As a result, in the event of a healthcare emergency, customers have to deplete their savings, which puts a strain on their future strategies. Reports indicate that Indians rely primarily on their private savings when it comes to dealing with healthcare crises. As medical technology improves and diseases multiply, the price of treatment increases. And it is vital to see that medical expenses are not limited to hospitals. Prices for doctor’s visits, identification tests, ambulance charges, operations, drugs, room rentals, etc., are also constantly rising. By paying a relatively inexpensive health insurance premium each year, you can overcome the burden of health care inflation and, at the same time, choose quality care without worrying about what it will cost you.

Healthcare prices have increased dramatically in recent times. As a result, in the event of a healthcare emergency, customers have to deplete their savings, which puts a strain on their future strategies. Reports indicate that Indians rely primarily on their private savings when it comes to dealing with healthcare crises. As medical technology improves and diseases multiply, the price of treatment increases. And it is vital to see that medical expenses are not limited to hospitals. Prices for doctor’s visits, identification tests, ambulance charges, operations, drugs, room rentals, etc., are also constantly rising. By paying a relatively inexpensive health insurance premium each year, you can overcome the burden of health care inflation and, at the same time, choose quality care without worrying about what it will cost you.

Bottom Line

It is a mistake to think that health insurance is only for people with severe or chronic illnesses or people at high risk of developing a disease or injury. Health insurance is also for those who are healthy. Taking out health insurance when you are in the prime of your life can help you stay healthy.…

What Are the Benefits of Getting a Car Loan?

Car loans enable individuals to get cars at retail prices then make monthly payments over time. After coming into an agreement with the financier or the lender concerning the first down payment, loan repayment period, interest rate, and so on, you will be able to drive the new vehicle off the lot. Although many people prefer to pay for the car using cash at purchase time, borrowing money to buy automobiles is common among buyers. Fortunately, people can conveniently get easy car loans from one of the best financiers to actualize their dreams of owning cars.

Below are some of the benefits of getting a car loan:

No Need for Collateral

Purchasing a car on loan provides one critical advantage since you do not lose anything. This is because the vehicle itself becomes the collateral for lenders in case of default in payment. The collateral subject is compulsory since it is the guarantee if one cannot settle the amount. The subject matter can be reposed or sold to recover the cash.

Purchasing a car on loan provides one critical advantage since you do not lose anything. This is because the vehicle itself becomes the collateral for lenders in case of default in payment. The collateral subject is compulsory since it is the guarantee if one cannot settle the amount. The subject matter can be reposed or sold to recover the cash.

Budget Improvement

When a car loan is obtained, all the budget changes. Initially, it takes some time to be familiar with the fact that every month end, some amount of money will be deducted from the salary to settle the loan. However, it gets easier in the future since you possess your preferred vehicle and enjoy the comfort. When the loan is taken from the bank, they develop a plan to contribute the payments without reducing the daily requirements.

Less Documentation

Getting a car by obtaining a loan needs a few documents compared to when you go for a home loan. For a car loan, a crucial document that has to be presented is the bank statements for the last three months to check the eligibility. However, this depends on the lending company’s policies on what they can prefer focusing on as they decide if an individual is eligible for the loan or not.

Getting a car by obtaining a loan needs a few documents compared to when you go for a home loan. For a car loan, a crucial document that has to be presented is the bank statements for the last three months to check the eligibility. However, this depends on the lending company’s policies on what they can prefer focusing on as they decide if an individual is eligible for the loan or not.

Savings for the Future

When you buy a new car, it is helpful since saving for the future is possible.This is because a new car is more economical in maintenance enabling one to save for future needs. A used car, on the other hand demand more service frequently. It can, therefore, reach a saturation point easily compared to a brand new one. The loan also enables one to have the pride of processing a new car by themselves.…

Finding the Right Accountant for Your Company

If you think that the task of an accountant is to complete and submit your tax returns only, you are definitely wrong. They can do a lot for business entities.

Besides attending to a company’s tax requirements, preparing payroll, and managing invoices, one of the most critical roles of an accountant is budgeting. With the right budgeting, your resources will be allocated efficiently, and this may include payment of debts and taxes and the many operational expenditures that you need to spend on. If you have a hard time following your cash flow, your accountant can make it simpler for you and fix irregularities. Indeed, an accountant is crucial for a company’s well-being and growth.

With the many functions of an accountant in a company, it helps to find one with the following qualities.

Technology-Driven